Working capital loans

built for ecommerce

Boost inventory, advertising, and more with Mercury Working Capital.

Funding for what’s next? Add to cart.

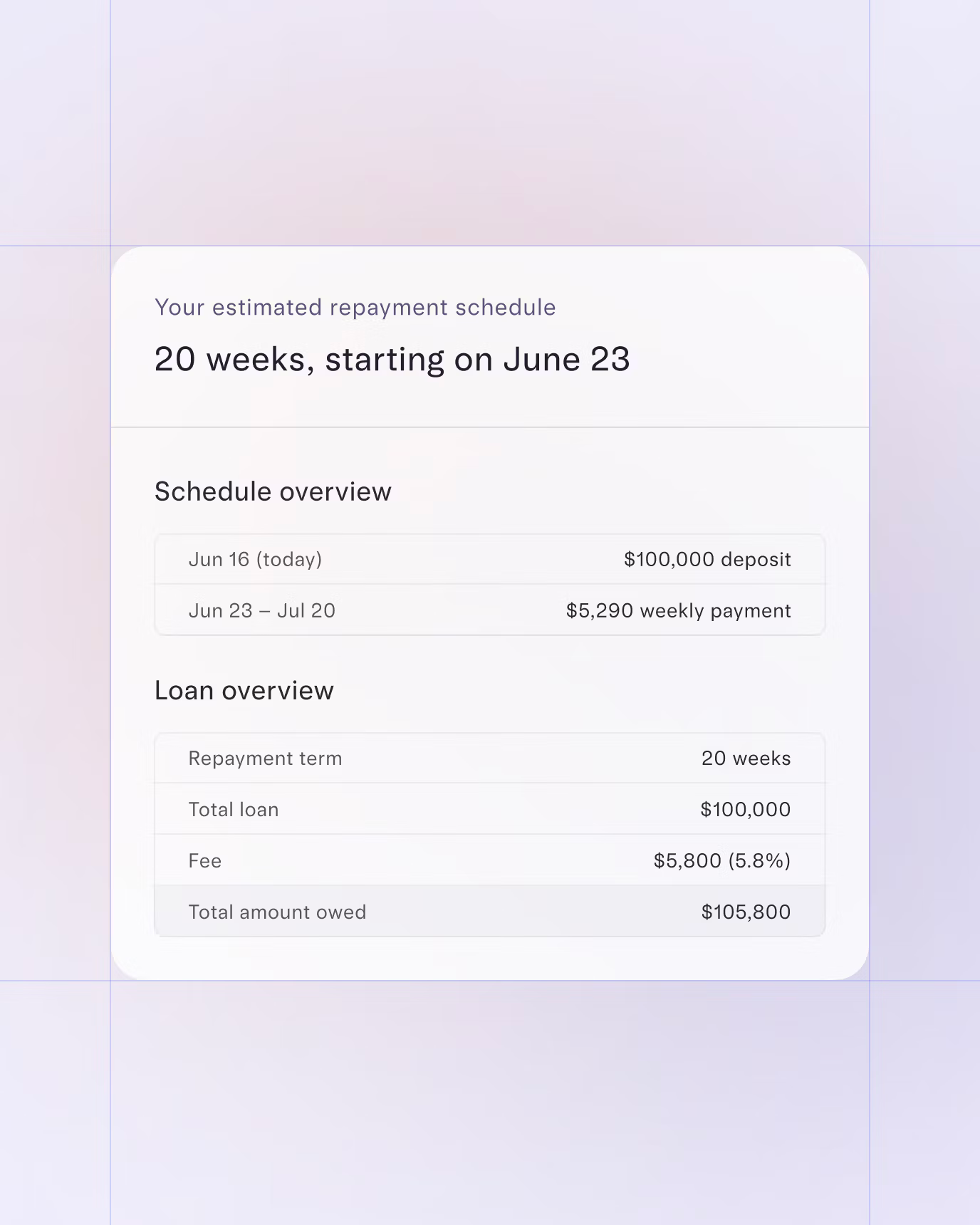

Flat-fee pricing and competitive rates

Easy-to-understand terms so you know your true cost of capital.

Fixed weekly repayment schedule

Forecast your finances without the unpredictability of revenue-based payback.

Long-term partnership

Get a helpful consultant with ecommerce expertise as you run, grow, and scale.

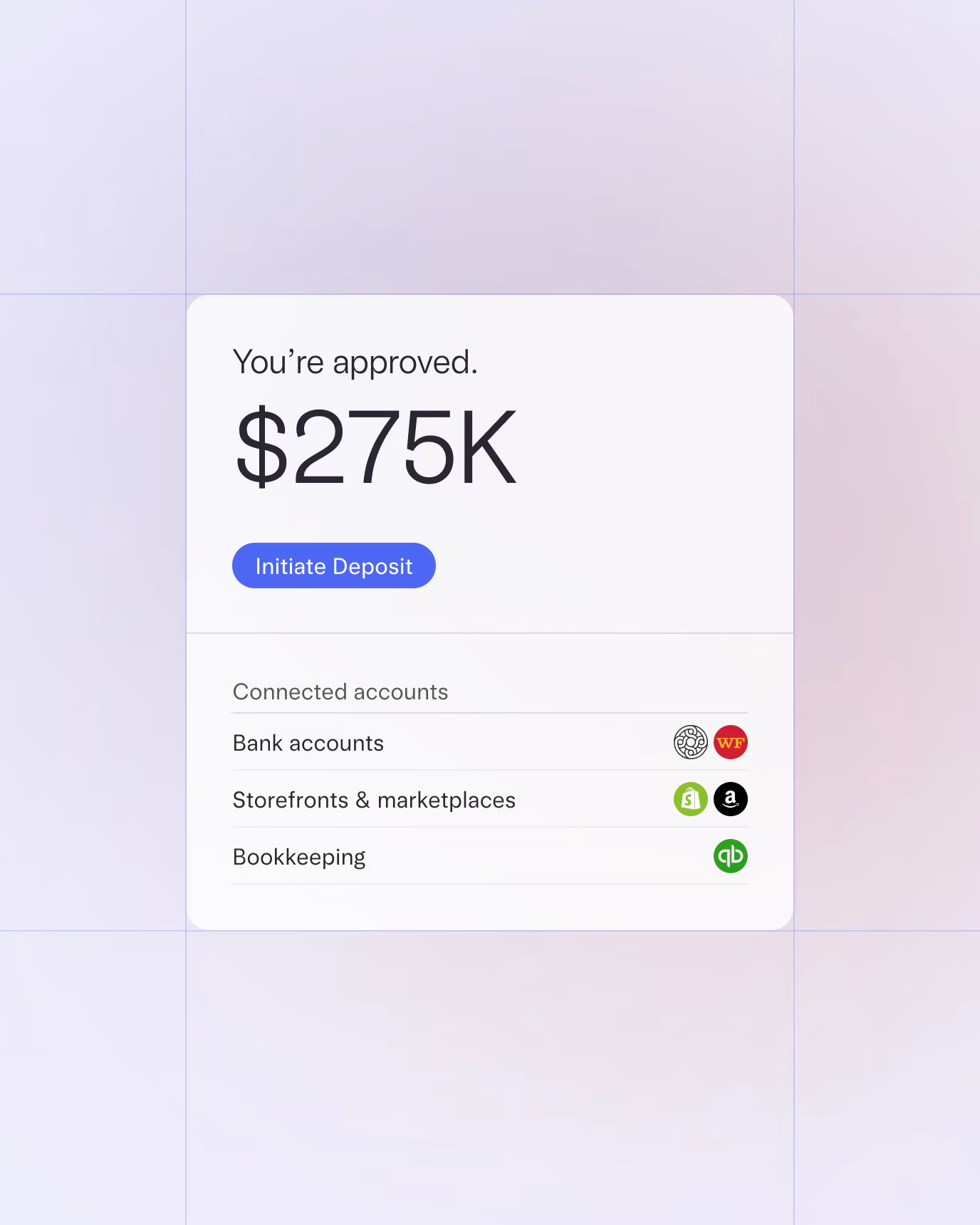

Transparent terms designed to help you grow

Get the most for your business

With our holistic underwriting process, we look at revenue from all your ecommerce sales platforms to ensure you get the best offer.

Unlock funding that doesn’t hold you back

- Use funds for anything your business needs — we trust you to know what’s best.

- Unsecured capital, no collateral required.

- No personal guarantee, so your personal assets aren’t on the line.

- No prepayment fees because we don’t think you should be penalized for growth.

Forecast the road ahead

With fixed weekly payments on your working capital loan, you’ll know exactly how much you’re paying and leave the unpredictability of revenue-based repayment behind.

Optimize how you operate with your Mercury Ecom Specialist

- Your Ecom Specialist will help ensure you have everything you need to scale — from banking to corporate cards,1 and everything in between.

- Need more capital? Your Specialist is at the ready to help with all your future lending needs.

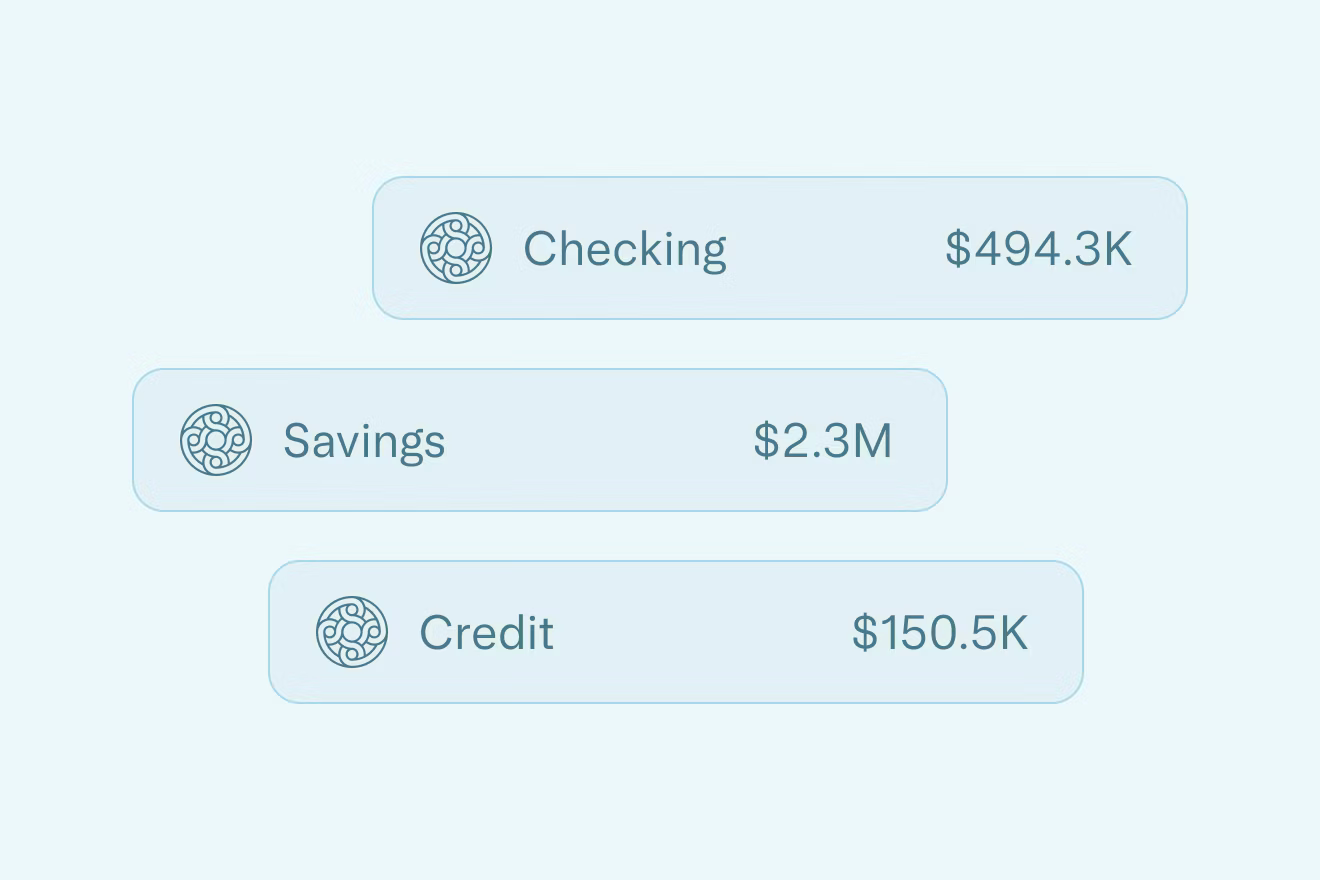

Simplified banking, lending, and financial workflows all in one place

Bank accounts

No monthly fees. $0 ACH, domestic and international (USD) wires, and checks.

IO credit card

Earn 1.5% cashback on every purchase and set custom limits for your team.

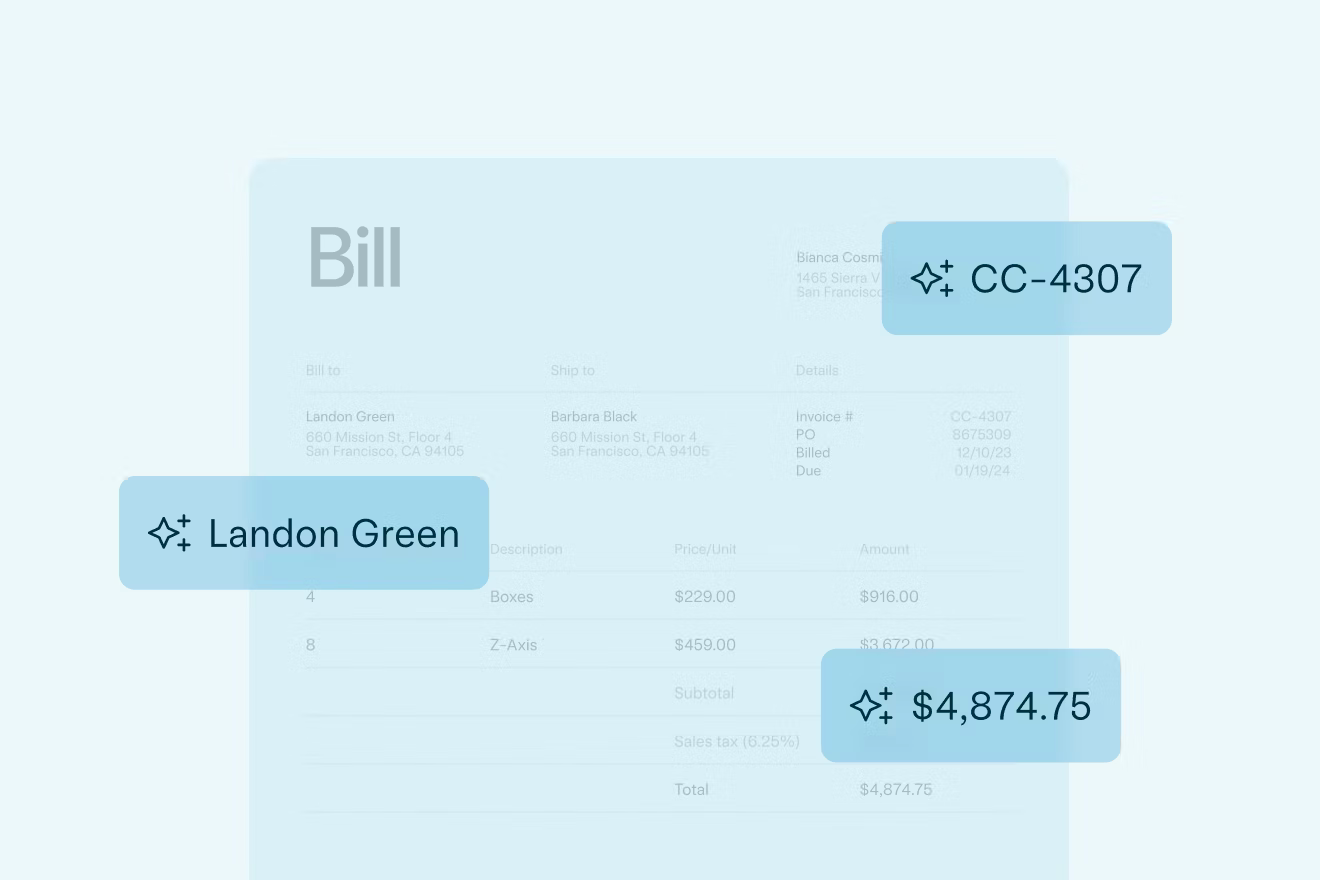

Bill pay

Drag and drop invoices to pay vendors in a

few clicks.

Fund your fullest potential

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

FAQ

What do I need to apply for an account?

You’ll need a U.S. company with a federal EIN, your company’s official formation documents, and a picture of your government ID (e.g., a passport or U.S. driver’s license).

Customers must have some type of existing or planned operations in the U.S. and a U.S. or international address for their principal place of business. This can be a residential address, but may not be a registered agent, PO box, or UPS box address. Our customer base includes startups and ecommerce companies, as well as venture capital firms with entities in the Cayman Islands, British Virgin Islands, and United Arab Emirates. Upon applying, we’ll review to ensure you have up-to-date formation documents and otherwise satisfy our onboarding requirements.

We cannot currently support accounts for businesses with founders or financial controllers living in the countries and regions listed here.

Are my deposits FDIC-insured?

Mercury checking and savings deposits are FDIC-insured up to $5M3 through our partner banks and use of sweep networks. As a broader effort, we are working on expanding all coverage even further. You can learn more about FDIC insurance here.

Where are my funds kept?

Mercury works with two FDIC-insured banks, Choice Financial Group and Evolve Bank & Trust. You can locate your Mercury account’s banking provider by logging in and viewing the banking partner listed on your Mercury statements.

Through each of our partner banks, Mercury customers get access to a sweep network of trusted banks. This sweep network provides up to $5M in FDIC insurance by automatically spreading your deposits across up to 20 different banks, without requiring you to open and manage separate bank accounts.

Our Treasury* product is offered through an additional partner, Apex Clearing Corp, who is a FINRA-regulated broker-dealer. The mutual funds that you can invest in through Mercury Treasury are managed by Morgan Stanley and Vanguard.

Can I apply for an account if I’m not physically in the United States or a United States resident?

Yes, we’re proud to support U.S. companies founded by people across the globe, as well as founders and venture capital firms with an entity based in the Cayman Islands, British Virgin Islands, and United Arab Emirates. Customers must have some type of existing or planned operations in the U.S. and a U.S. or international address for their principal place of business. This can be a residential address, but may not be a registered agent, PO box, or UPS box address.

We cannot currently support accounts for business with founders or financial controllers living in the countries and regions listed here.

We’d love to support residents of more countries over time, so let us know at hello@mercury.com if you live in one of the above countries and we’ll let you know if anything changes.

What does it cost to use Mercury for businesses?

Mercury business banking is free to use. There are no account minimums, overdraft fees, monthly fees, or account opening fees. However, certain advanced features may incur fees. These include: making mass payments on our API, accessing Mercury Treasury account management, making non-USD business debit or credit card transactions, exchanging money in non-USD currencies, and sending USD internationally with optional premium processing.

Customers have the option to select a paid plan (starting at $35/month) for access to these advanced payment workflows, including more invoicing features, our enriched NetSuite automations, and reimbursing out-of-pocket expenses for more than 5 active users per month. Learn more about pricing here.

If your business doesn’t need access to these advanced financial workflows quite yet, don’t worry. Our business checking and savings bank accounts are free for everyone. Anyone can send payments from their Mercury account without subscribing to a paid plan. When you’re ready, you can upgrade to access the advanced features at the price point that makes sense for your company and volume of business.