Maximize your money.

Minimize your risk.

Earn up to 4.65% yield1 with high-liquidity, lower-risk portfolios powered by Vanguard and Morgan Stanley. Exclusively for Mercury account holders.

Strategic cash management

made simple

Effortlessly earn up to 4.65%1

Qualify for Mercury Treasury with a minimum balance of $500K across your Mercury accounts.

Secure your runway

Your money is invested in lower-risk mutual funds held in your name.

Automate your cash management

Set custom auto-transfers between your operating and investment accounts.

Keep your capital close by

Get the flexibility you need with highly-liquid investments right in your Mercury account.

Growth for the long term, flexibility in the short term

Customize your portfolio allocation across two top-tier funds

The Vanguard Treasury Money Market Fund is 99.5% invested in U.S. government-backed securities

The Morgan Stanley Ultra-Short Income Portfolio invests in commercial paper and certificates of deposit and carries the highest Fitch rating

Personalized portfolio management services are available for customers with $25M in Mercury balances

Set your finances on auto-pilot

Mercury has made the process of transferring funds between a high-yield Treasury account and a checking account remarkably seamless, ensuring we make the most of every dollar.

Amaro Luna2

Co-founder, Telegraph

Unlock high yields without locking up your money

Unlike other high-yield investments, your money is always within reach with Mercury Treasury. You can easily transfer funds to your checking account within 1–3 business days.

Earn up to 4.64% yield.1

No surprise fees.

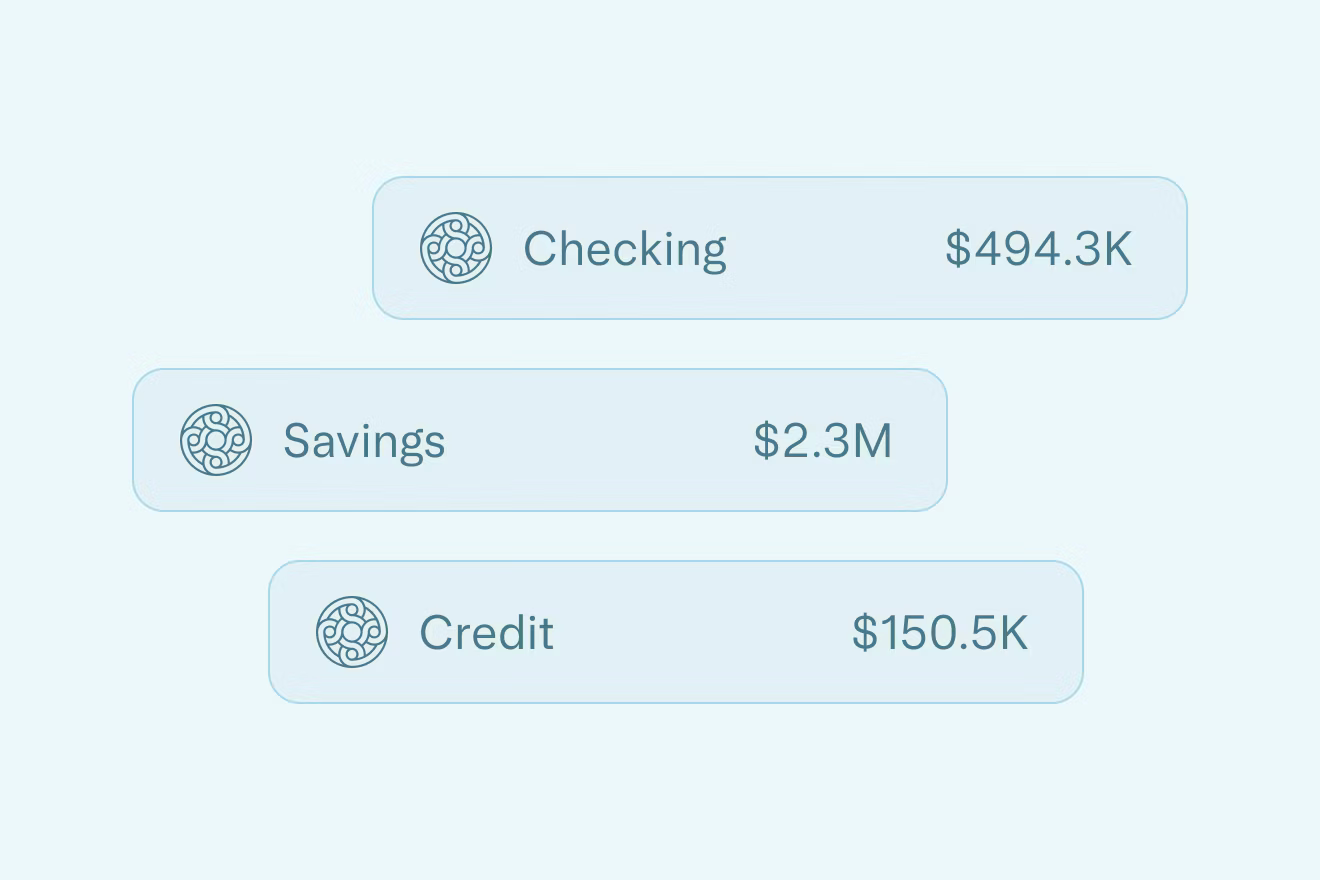

Total Mercury deposits

Yield1 (net of fees) up to

> $20M

4.64%

$10–$20M

4.55%

$5–$10M

4.45%

$2–$5M

4.35%

$500K–$2M

4.20%

< $500K

Not eligible for Mercury Treasury

There are no fees to open an account or transact with Mercury Treasury. You’ll be charged a small percentage of your total monthly Mercury Treasury positions at a rate determined by the total deposits held across all your Mercury accounts, ranging from 0.15% to 0.60%. All yield figures are net of fees.

Take your portfolio to the next level

Get access to personalized portfolio management with Mercury Treasury Solutions by Morgan Stanley

- Qualify with a $25M balance across Mercury accounts

- Maximize yield through a wide range of short-term securities

- Get white-glove service from Morgan Stanley’s experienced portfolio management team

Access an entire financial platform powered by the bank account

Checking and savings accounts

Secure up to $5M in FDIC insurance through our partner banks and their sweep networks.

IO credit card

Confidently scale your team with the IO Mastercard. Earn 1.5% cashback6 with startup-friendly credit limits.

Venture debt

Fuel your growth with startup-friendly Venture Debt.

Venture Debt

Supercharge your growth and extend your runway with Mercury Venture Debt.

Mercury Raise

Connect with investors, founders, and experts via our startup success platform.

Startup perks

Get discounts on hundreds of popular tools, including AWS and Google Cloud.

FAQs

What do I need to apply for an account?

Are my deposits FDIC-insured?

Where are my funds kept?

Can I apply for an account if I’m not physically in the United States or a United States resident?

What does it cost to use Mercury for businesses?

Realize your capital’s full potential

Apply online in 10 minutes or less.