Banking with built-

in peace of mind

Keep your funds, data, and account safe and secure with multiple layers of advanced protection.

Why 200K+ businesses bank on Mercury

Profitable since June 2022

We’re focused on sustainable growth.

Up to $5M in FDIC insurance1

Your money is safe with expanded protection through our partner bank and their sweep network.

97%+ of deposits are FDIC-insured2

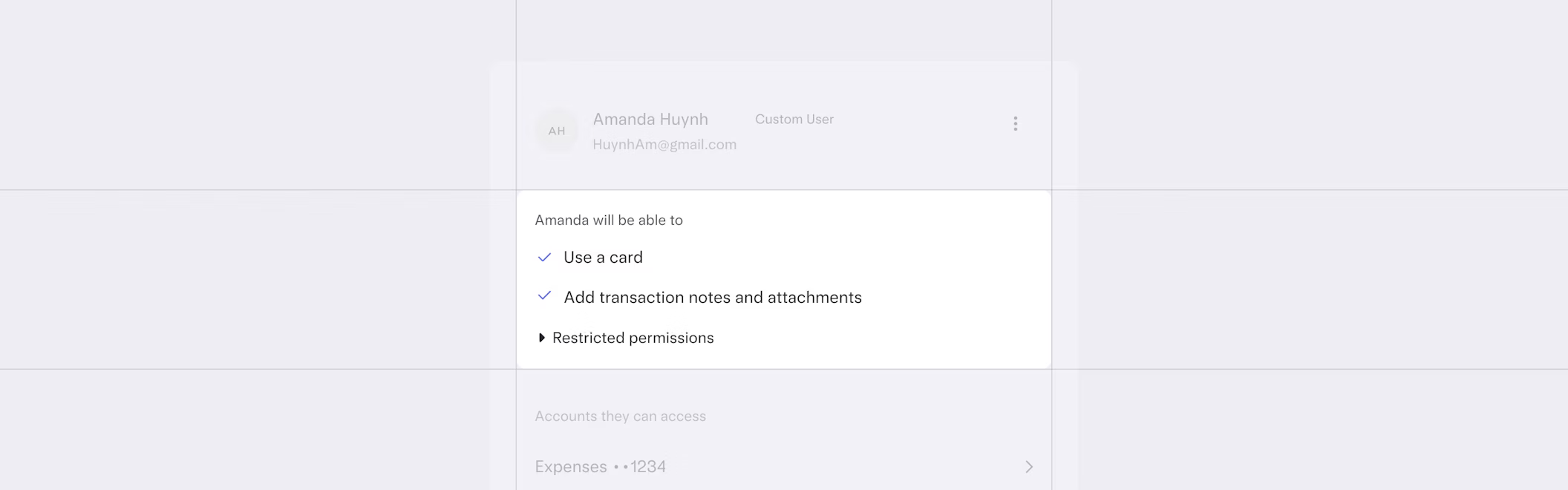

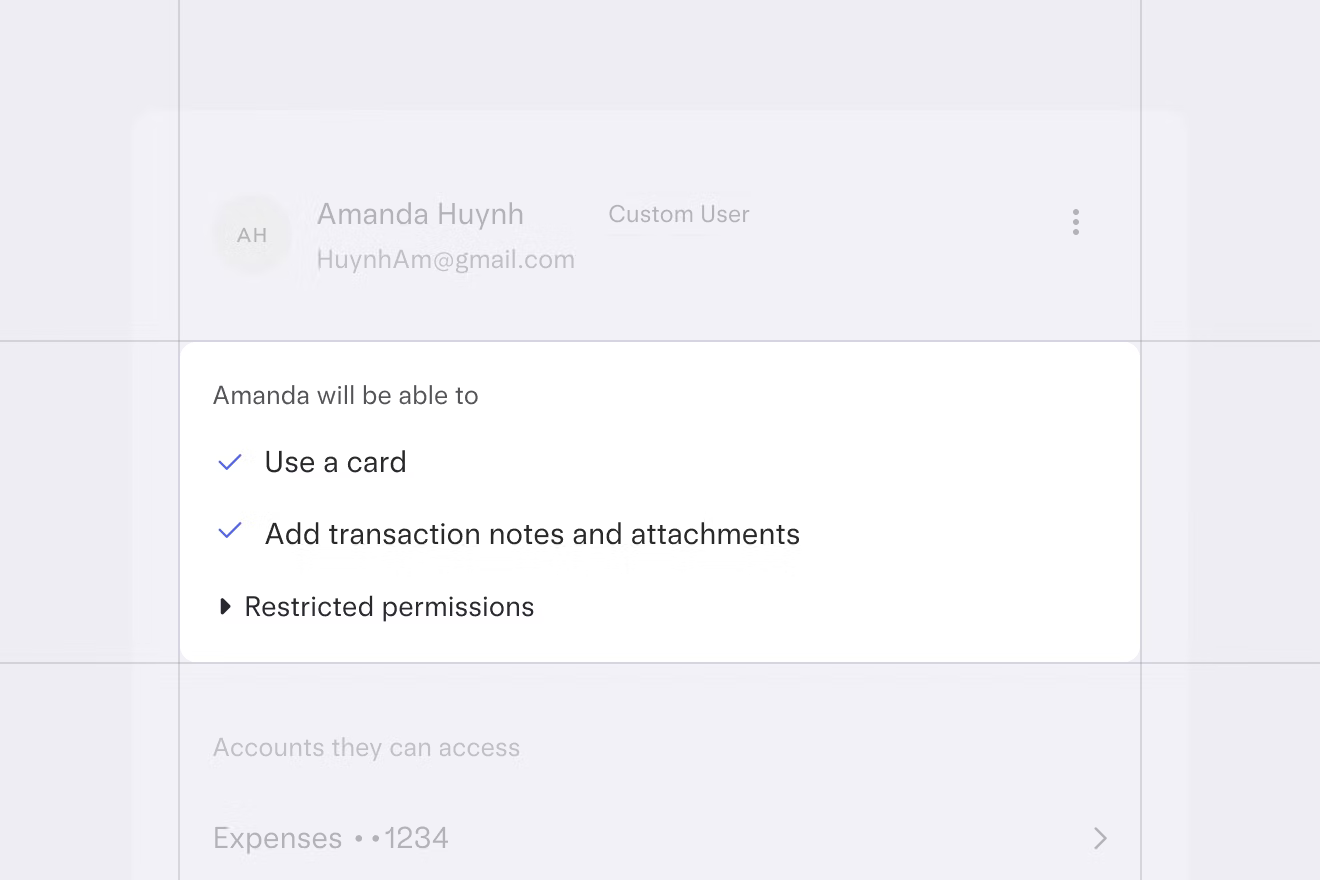

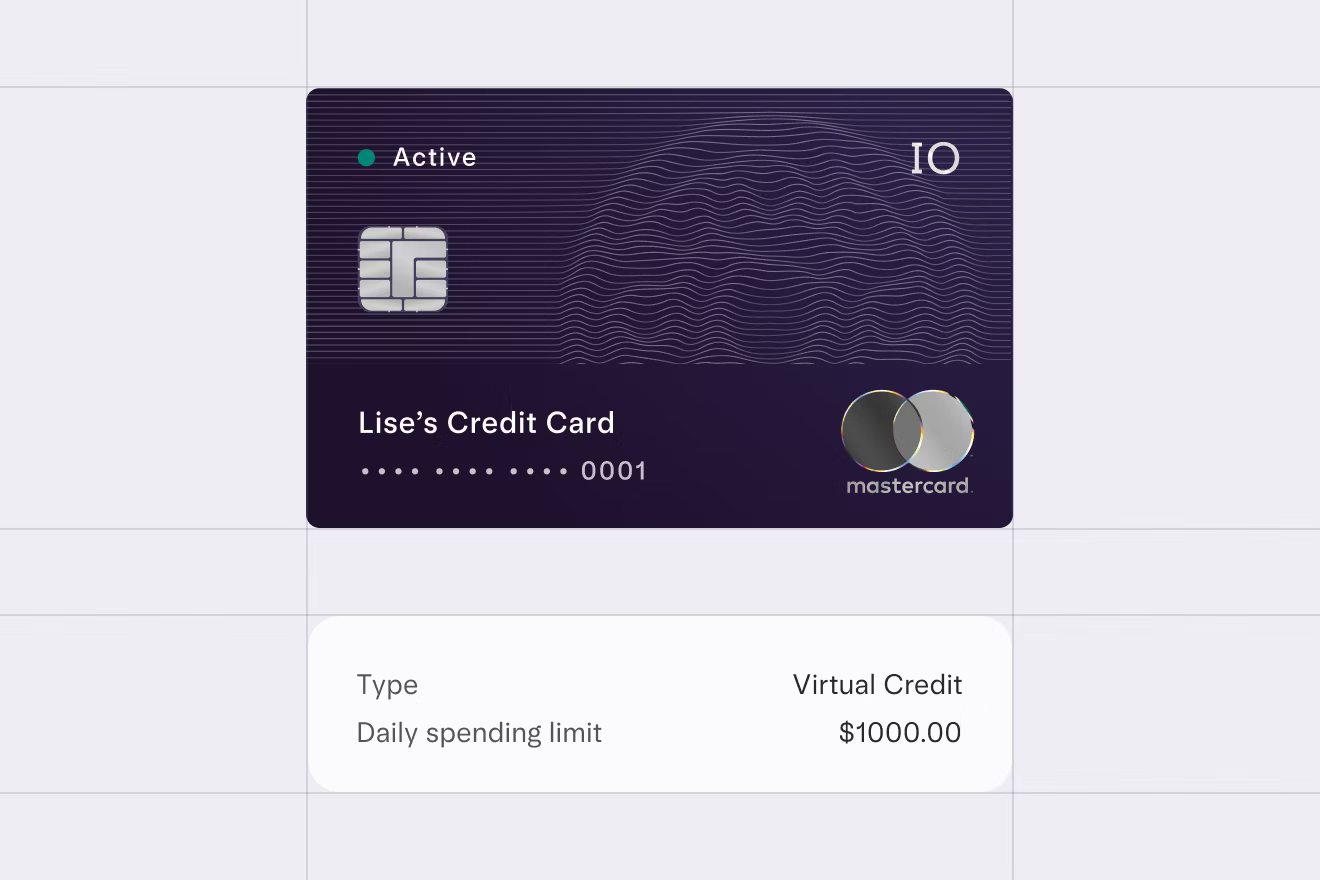

Create multiple accounts for your family, team, and financial advisor with custom permissions.

How we keep your funds safe

Watch your savings climb with 4.25% APY1

Every Mercury account is structured as an individual demand deposit account (DDA), giving you full ownership, transfer rights, and FDIC insurance eligibility by law — with no middleware in between.

Never lose sight of

your

funds’ protection

With Mercury Vault enabled on every account, you have an automatic and up-to-date view on exactly how your funds are protected.

Diversified by design

We spread your deposits across a network of FDIC-insured banks via our partner banks. The result is your team’s optimal, diversified banking setup — all through a single dashboard.

How we protect your account

Never lose sight of

your

funds’ protection

With Mercury Vault enabled on every account, you have an automatic and up-to-date view on exactly how your funds are protected.

Profitable since June 2022

We’re focused on sustainable growth.

Up to $5M in FDIC insurance1

Your money is safe with expanded protection through our partner bank and their sweep network.

97%+ of deposits are FDIC-insured2

Create multiple accounts for your family, team, and financial advisor with custom permissions.

Diversified by design

We spread your deposits across a network of FDIC-insured banks via our partner banks. The result is your team’s optimal, diversified banking setup — all through a single dashboard.

Room for everyone in your life

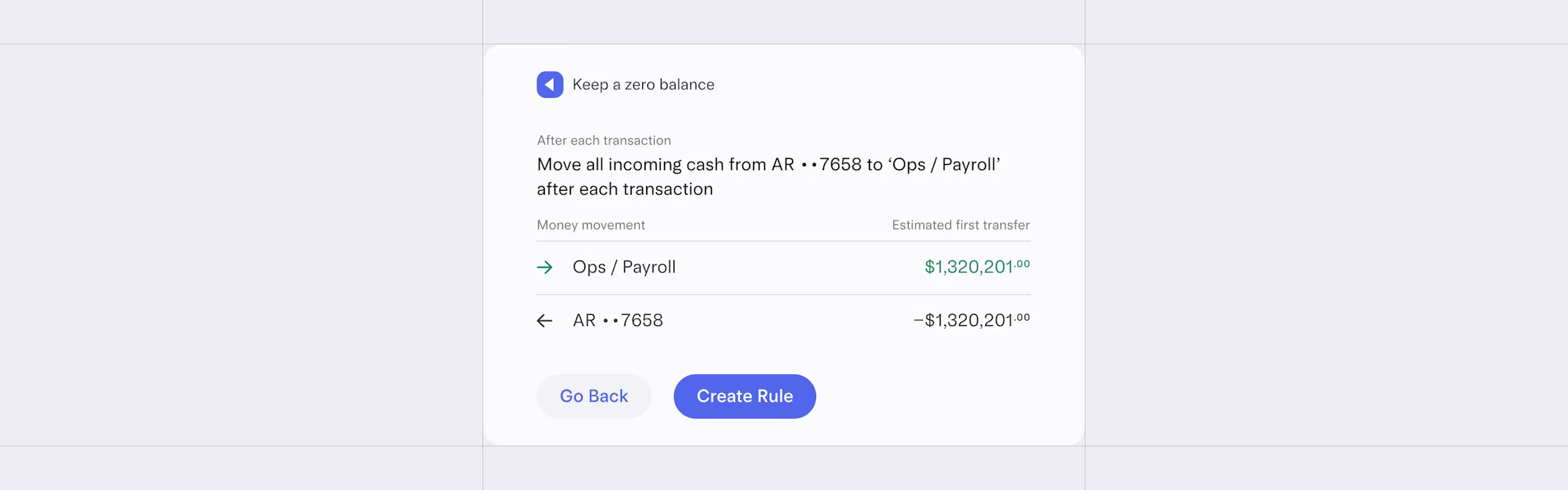

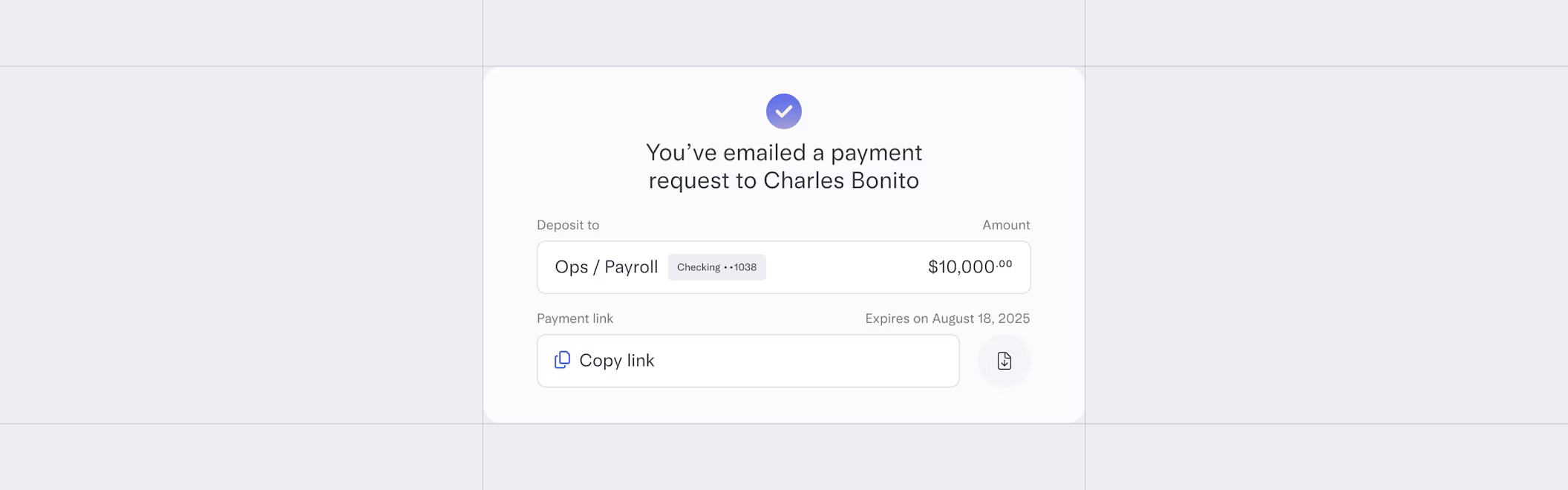

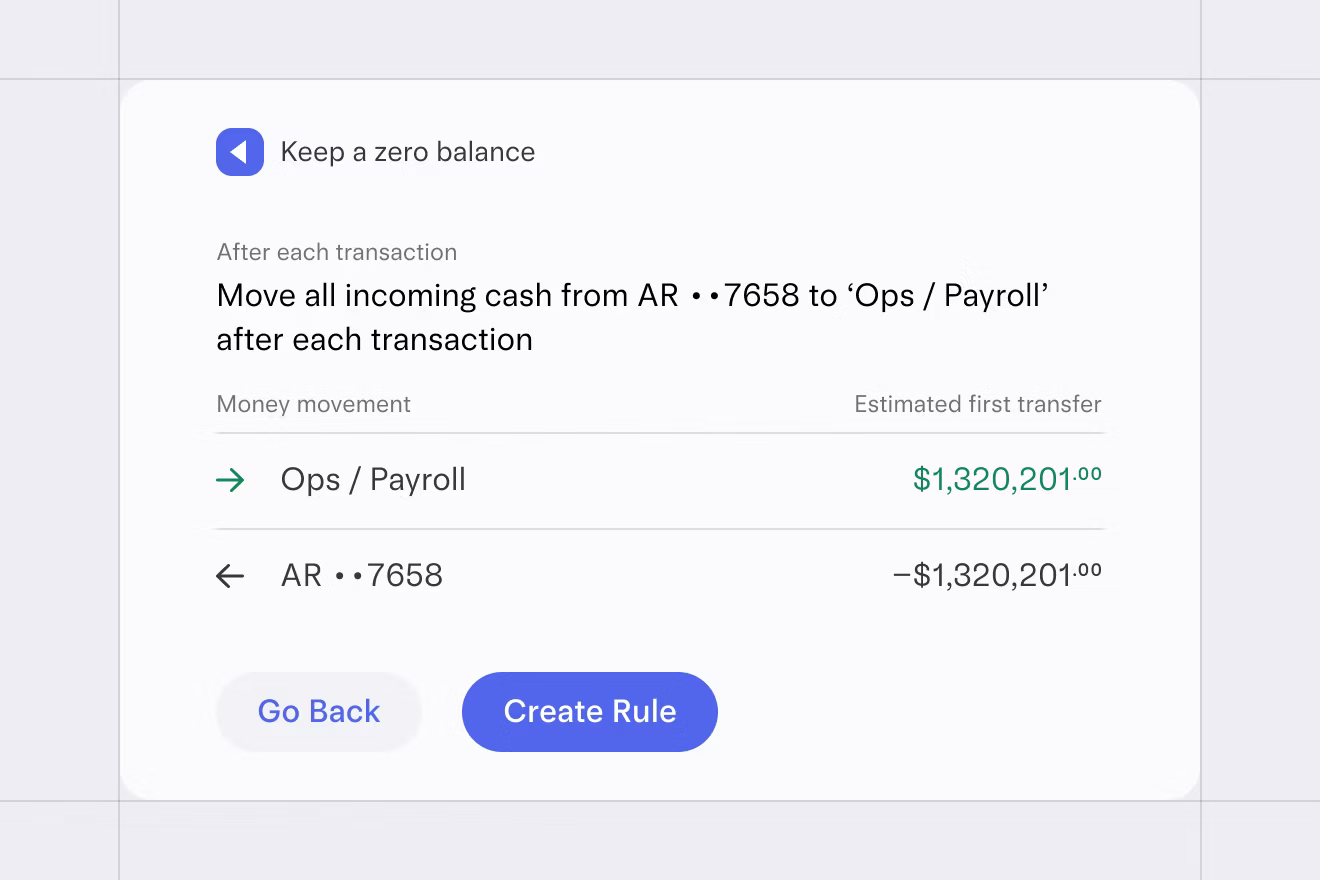

Receive-only AR accounts

Maintain a one-way flow of money by applying a zero balance auto-transfer rule to your AR accounts.

Your data. Your eyes only.

Some things should always be kept private. That’s why we go the extra mile to protect your data.

Never lose sight of

your

funds’ protection

With Mercury Vault enabled on every account, you have an automatic and up-to-date view on exactly how your funds are protected.

SOC 2 Type II compliance

Our security protocols and processes are first rate, and we undergo rigorous independent auditing to maintain them.

Robust encryption

We use strong, industry-standard protocols to keep your data safe and confidential, at rest and in transit.

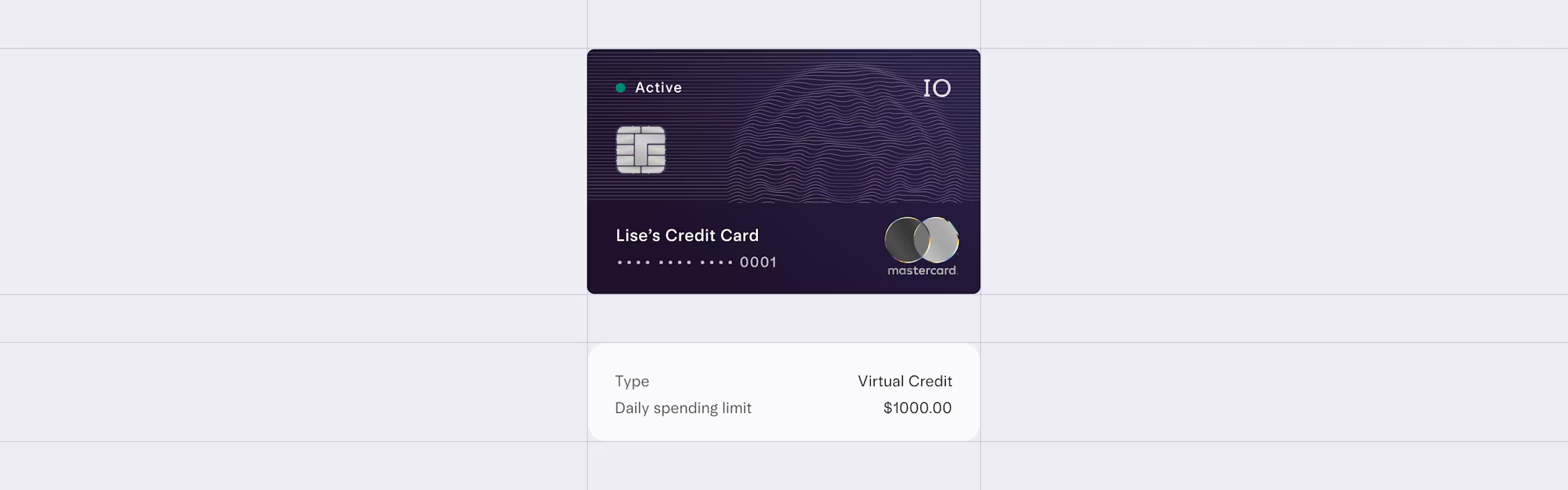

PCI standards

We understand how important your credit card information is and we uphold PCI compliance to ensure it stays safe.

You have questions. We have answers.

What do I need to apply for an account?

Are my deposits FDIC-insured?

Where are my funds kept?

Can I apply for an account if I’m not physically in the United States or a United States resident?

What does it cost to use Mercury for businesses?

Experience a new standard

in banking security

Build with complete confidence when you start banking with Mercury.