Get growing with

the IO credit card

Unlock unlimited cashback, higher credit limits, and spend management tools. Exclusively for Mercury account holders.

Engineered for the startup journey

1.5% cashback on all spend

Easy and straightforward rewards

Higher credit limits for startups

Harness more spending power

Low cash balance minimum

Qualify with a $25K balance

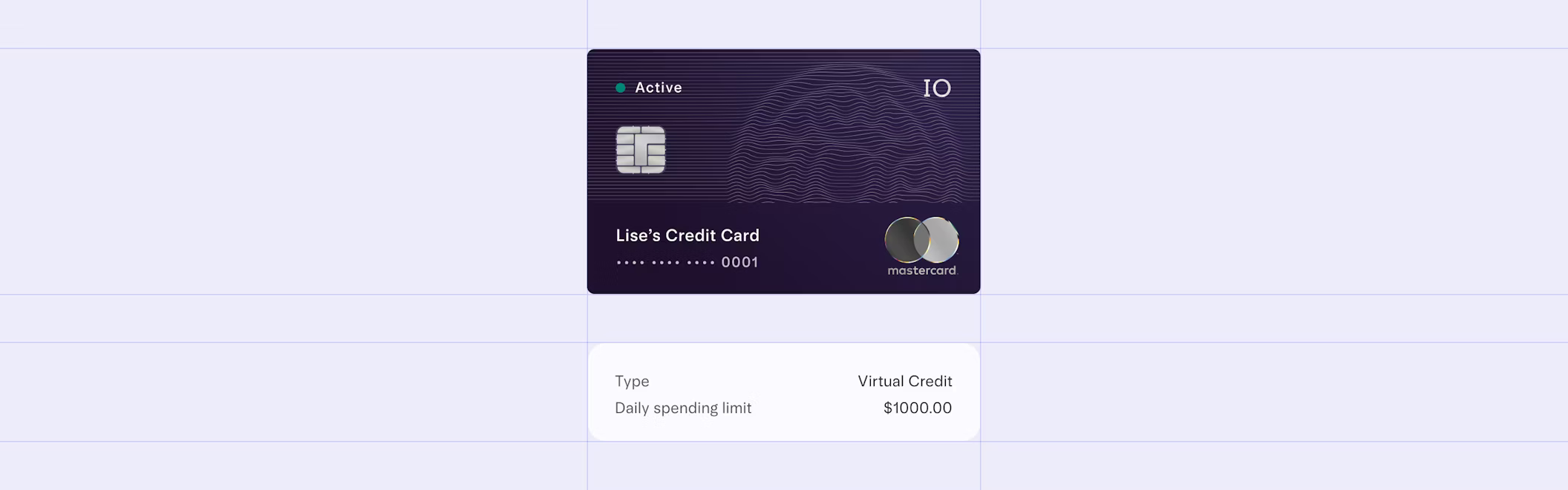

Instant virtual cards for your team

Start spending immediately

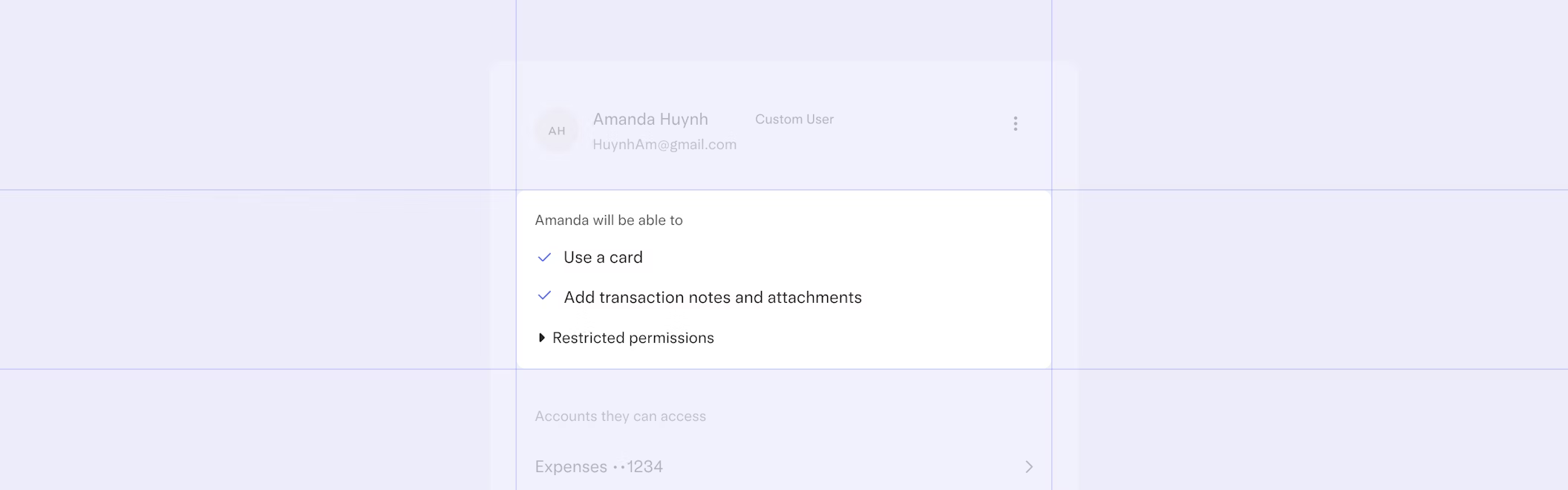

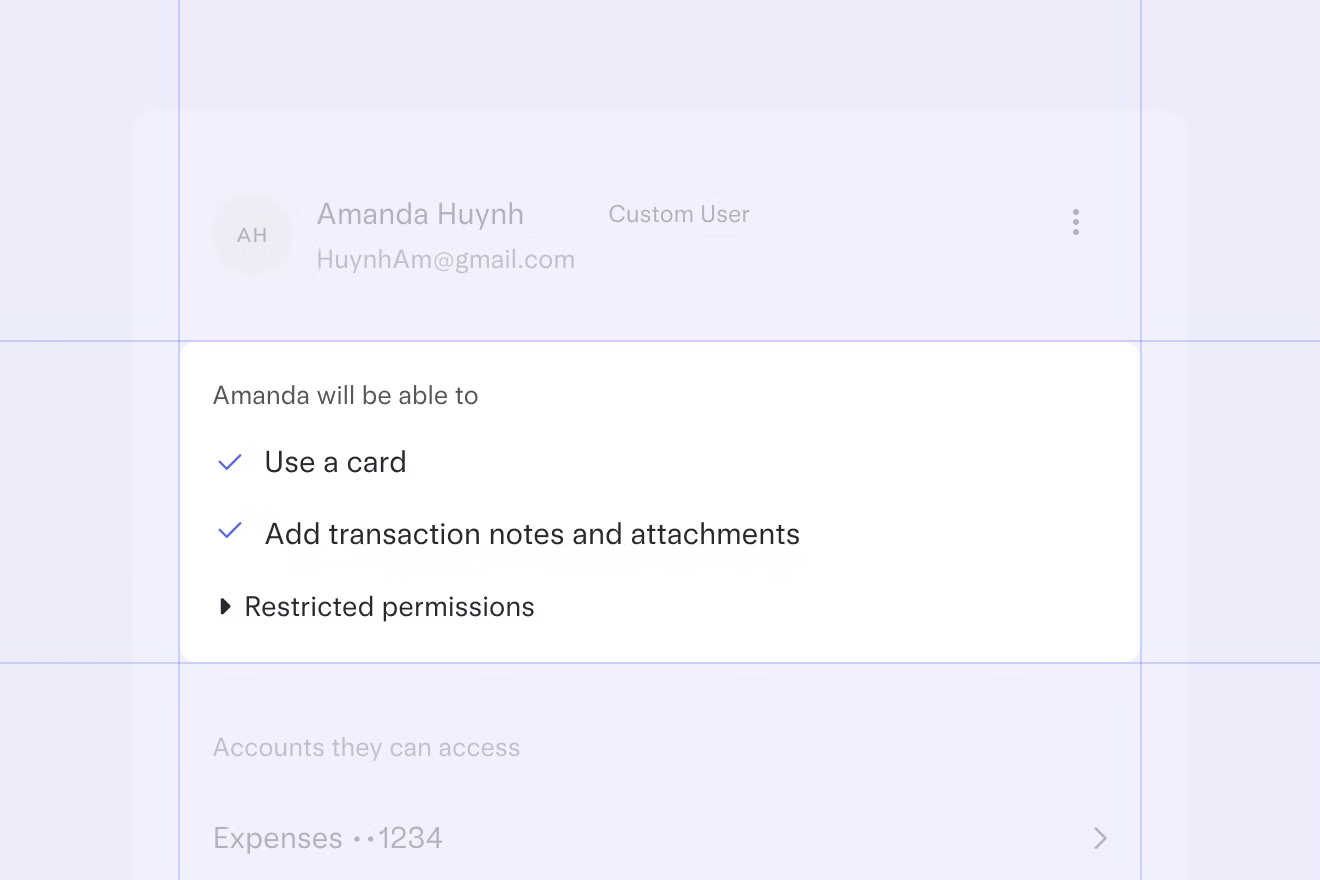

Spend management tools

Maintain control as you scale

Simplify your finances

Consolidated banking and cards

Scale confidently with powerful spend management tools

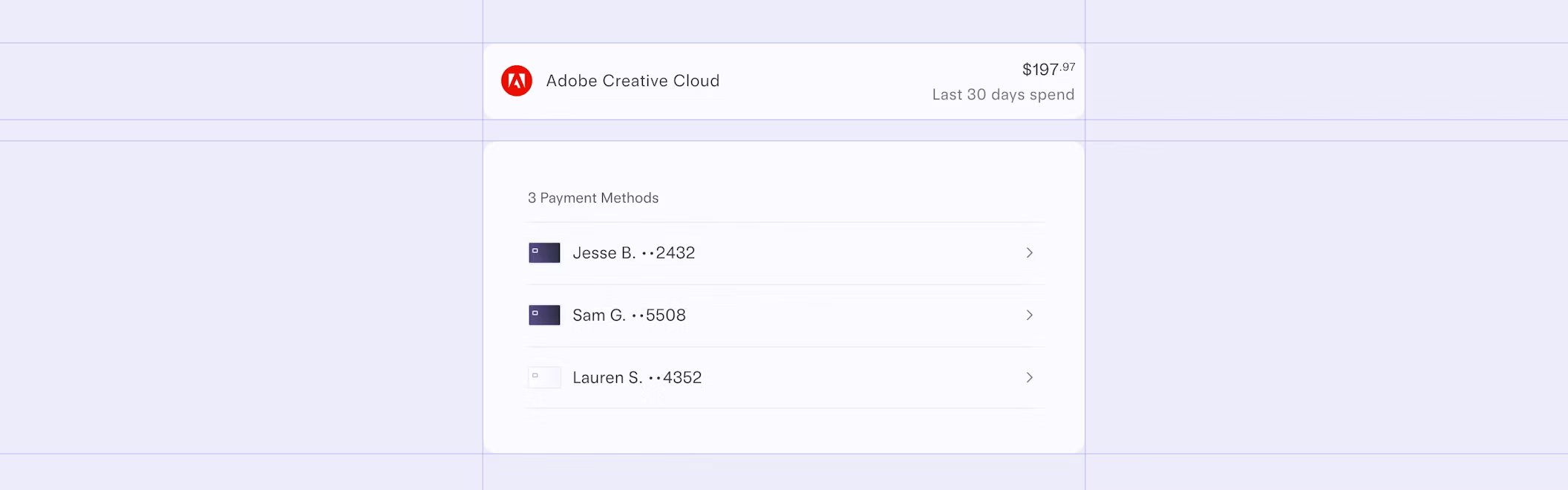

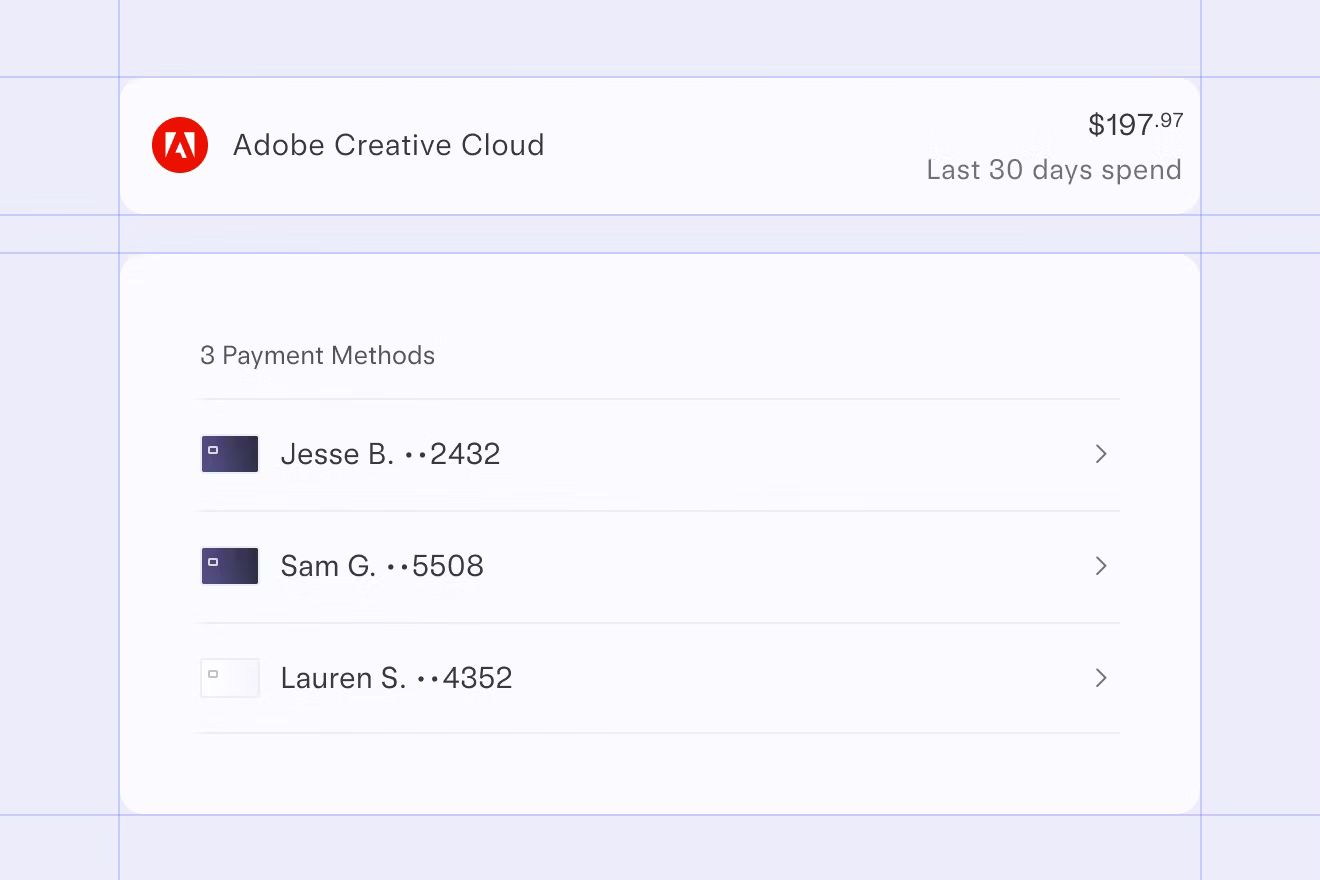

Cards for your team

Issue as many cards as you need to your team – individually or in bulk with our Google Workspaces integration.

Accelerate your growth with the IO Mastercard1

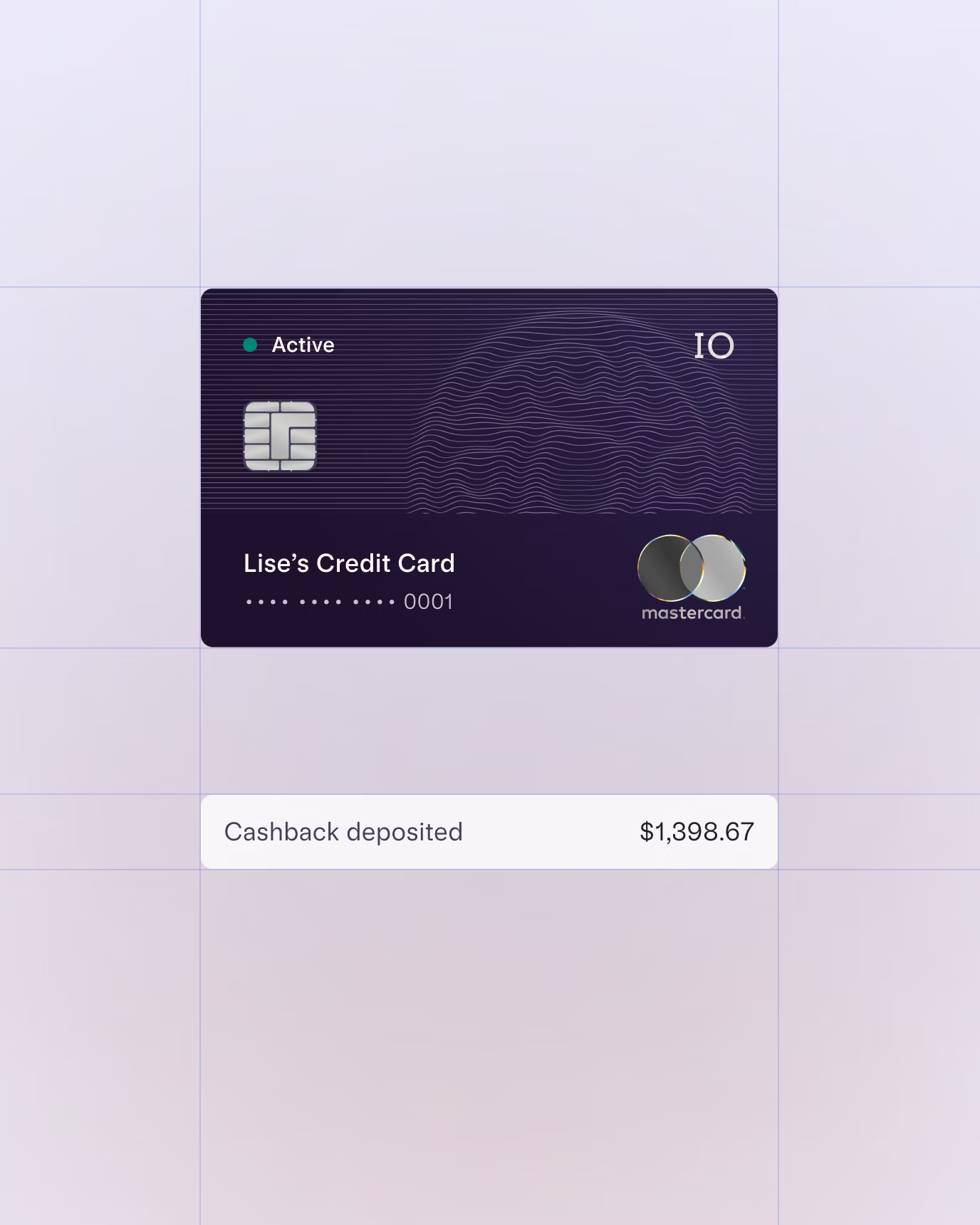

Increase cash flow with automatic cashback2

Unlimited 1.5% cashback on all spend

Automatically deposited into your account

No confusing points system

No manual redemption

Start spending at startup speed

Qualify for IO with an industry-low $25K cash balance minimum3

Get higher credit limits through our startup-friendly underwriting model

Start spending immediately with virtual cards

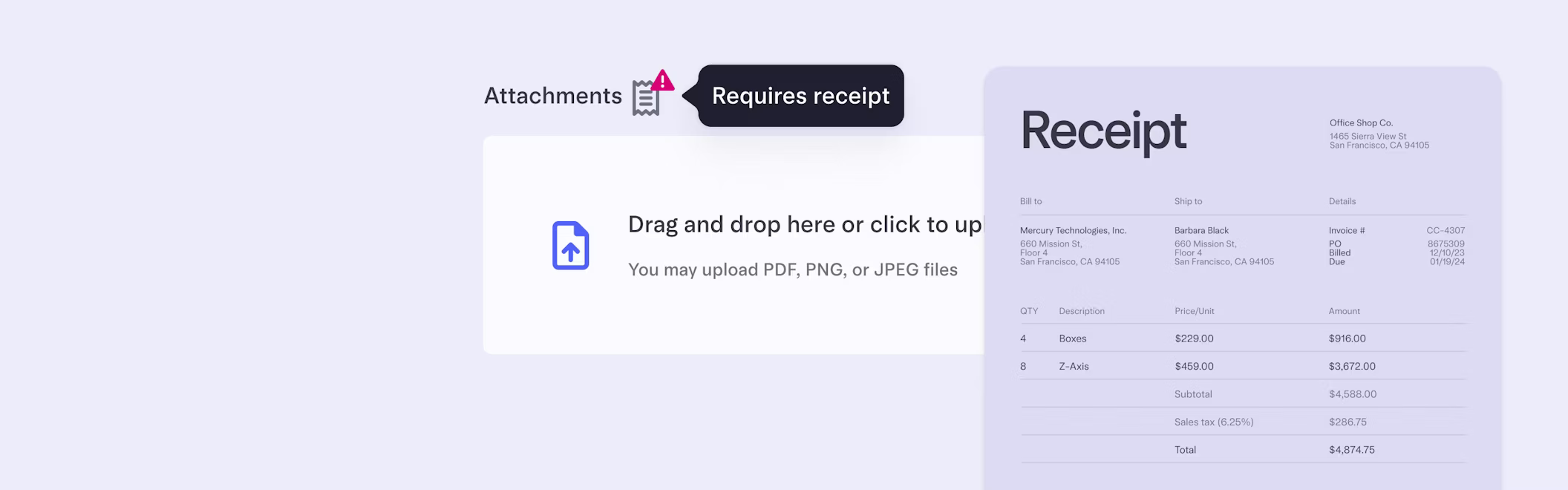

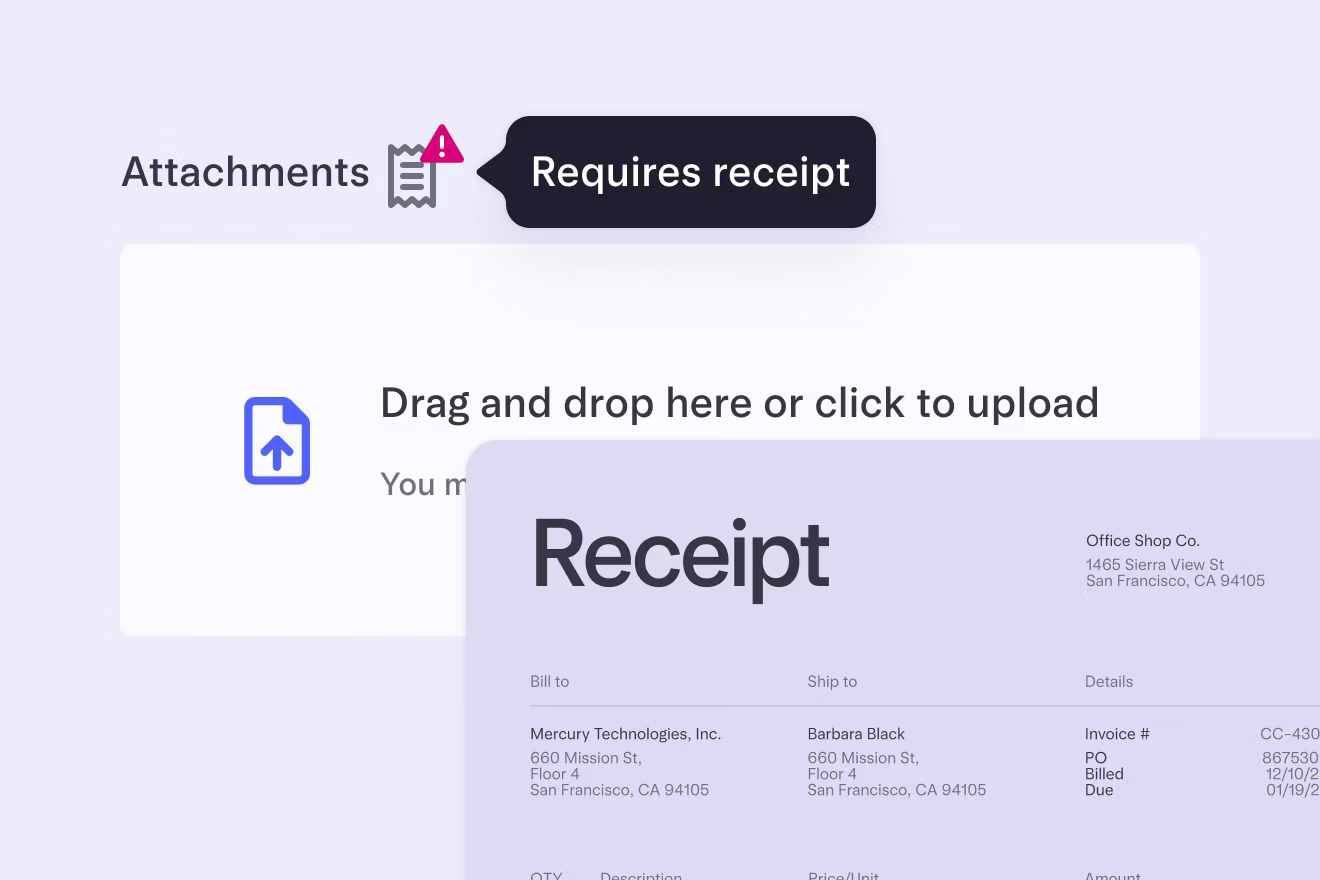

Get time back with built-in finance automations

- Close the books faster with QuickBooks and Xero integrations

- Ditch data entry with transaction categorization syncing

- Generate NetSuite-friendly reports

There’s more to IO

Just one part of Mercury’s full financial platform

Bank accounts4

Checking and savings accounts with up to $5M in FDIC insurance

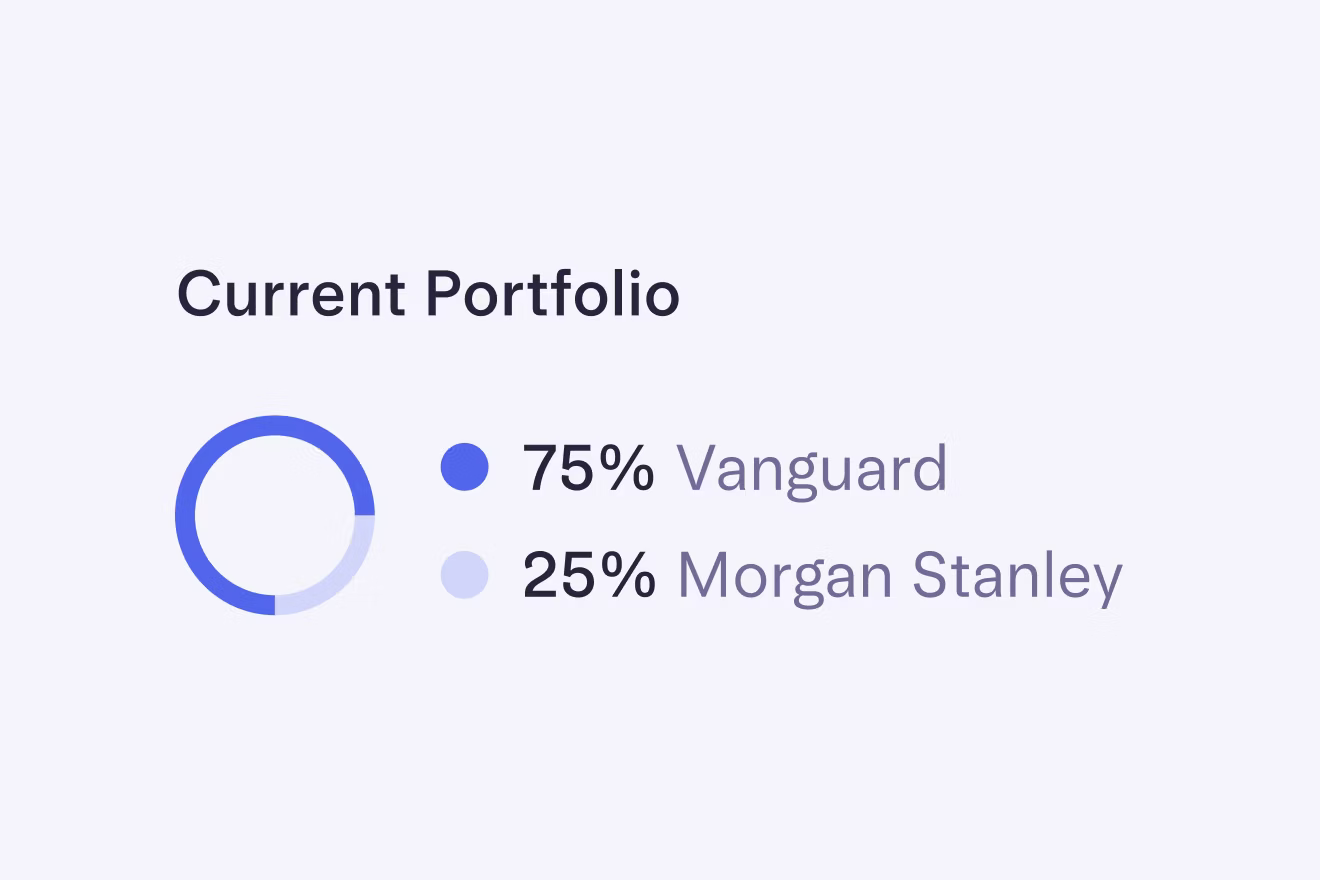

Treasury6

Earn yield on idle cash right alongside your operating accounts.

SAFEs

Easily create and manage SAFEs right inside Mercury, plus potentially save money on legal fees.

Mercury Raise

Connect with investors, founders, and experts via our startup success platform.

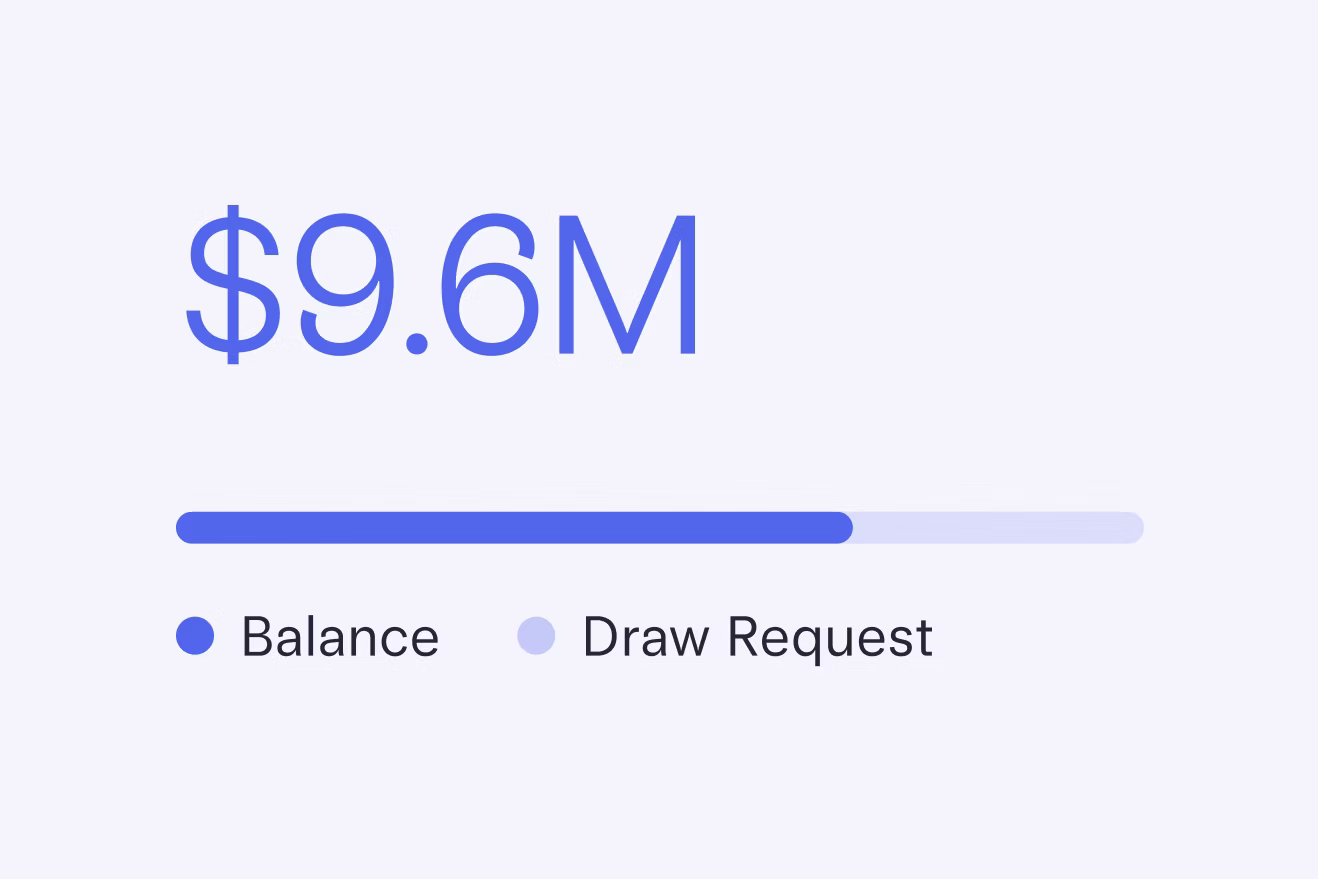

Venture debt

Supercharge your growth and extend your runway with Mercury Venture Debt.

Startup perks

Get discounts on hundreds of popular tools, including AWS and Google Cloud.

If you have questions, we have answers

What do I need to apply for an account?

Are my deposits FDIC-insured?

Where are my funds kept?

Can I apply for an account if I’m not physically in the United States or a United States resident?

What does it cost to use Mercury for businesses?

Ready, set, grow

Start spending – and growing – with credit cards available to Mercury account holders.