The Mercury Personal

waitlist is open

Powerful personal banking for one all-inclusive subscription of $240/year.

One subscription, endless ways to optimize your money

Earn competitive APY on savings (currently 4.25%)1

Never miss an opportunity to grow with high-yield savings accounts with no minimum balance.

Get up to $5M FDIC insurance2

Your money is safe with expanded protection through our partner bank and their sweep network.

Make banking3 a breeze

Send no-fee domestic wires, set auto-transfer rules, drag-and-drop bills, and tackle tasks in no time.

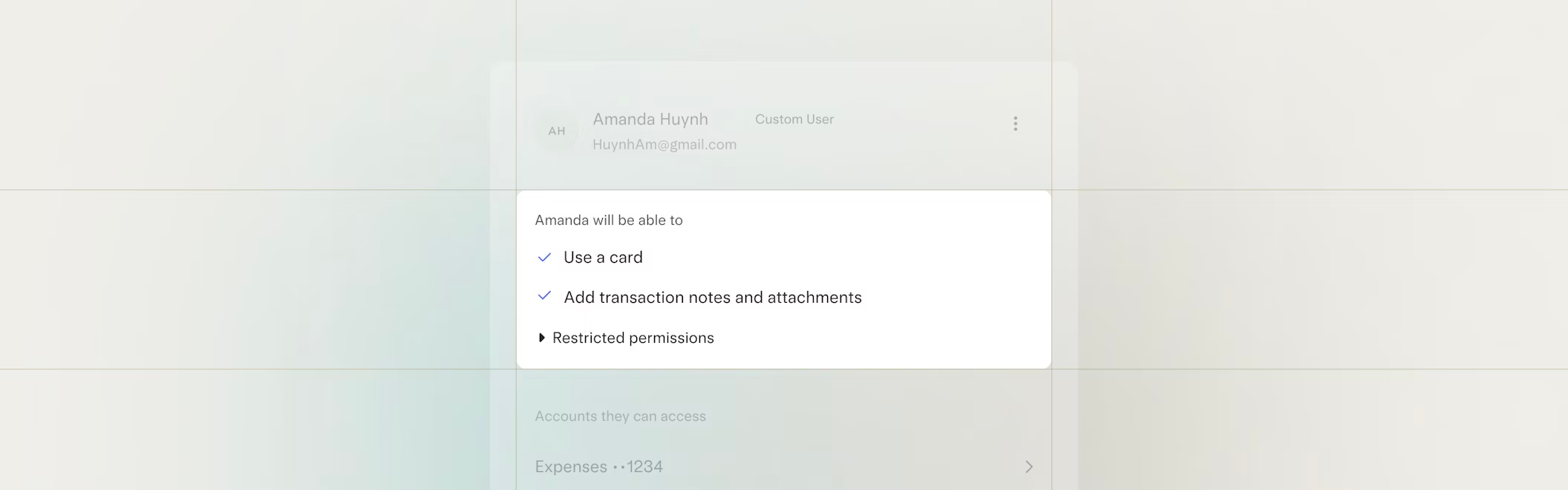

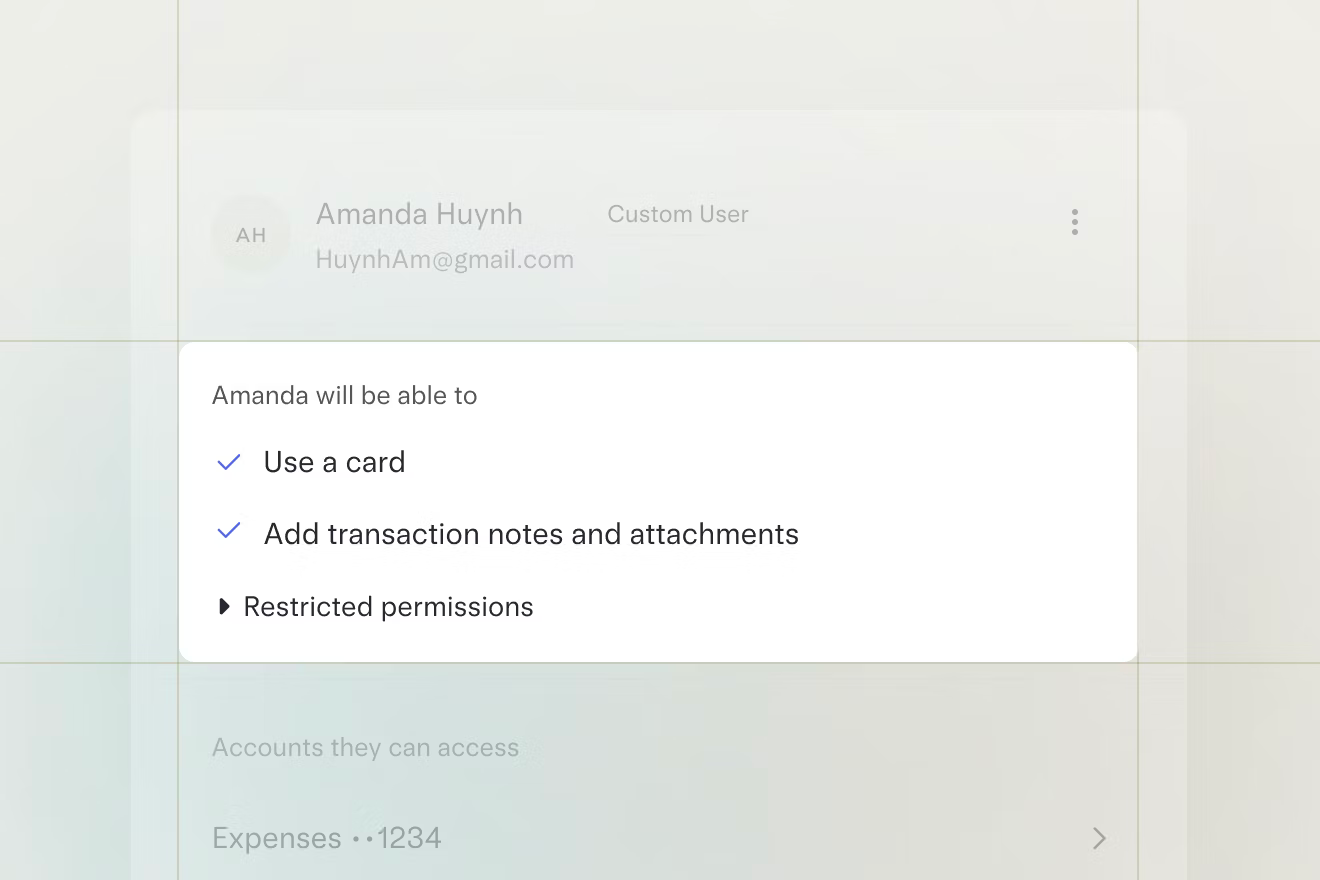

Share access with anyone

Create multiple accounts for your family, team, and financial advisor with custom permissions.

Your financial operating system just got an upgrade

Transparent pricing

No hidden or monthly fees No hidden or monthly fees No hidden or monthly fees

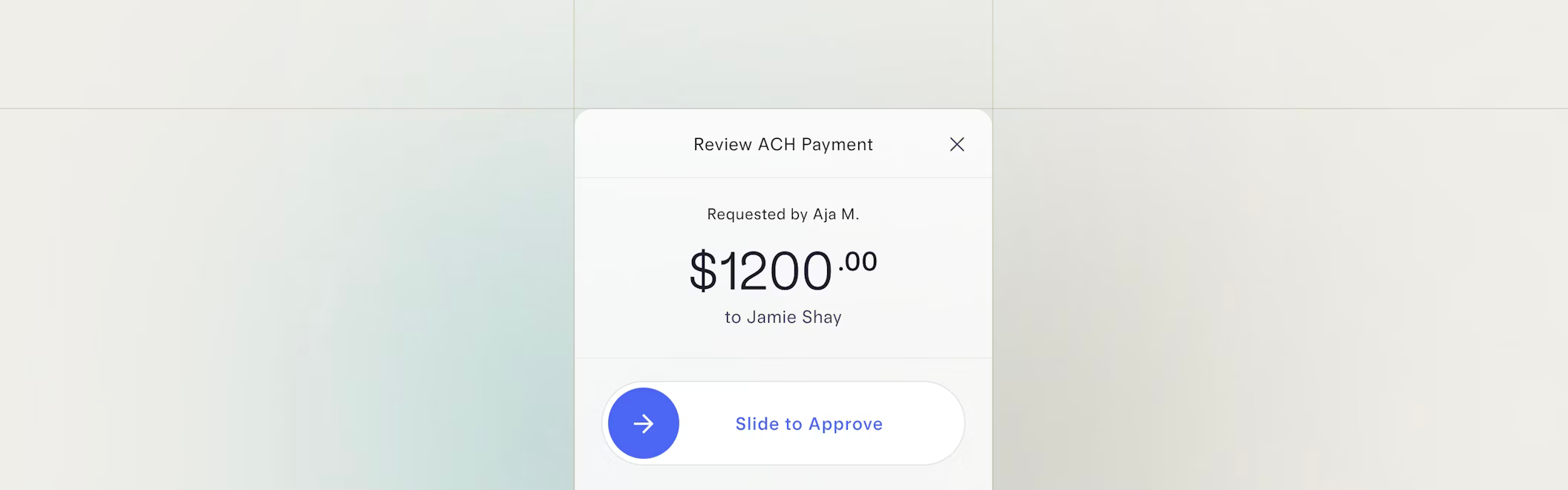

Seamless payments

Make scheduled & recurring payments via ACH, wire, or check ACH, wire, or check

Custom approvals

User-level permissions and controls User-level permissions and controls User-level permissions and controls

Make every dollar do

more, without doing a thing

A competitive APY1 on your savings, powerful software, and protection for it all.

Watch your savings climb with 4.25% APY1

Cover the cost of your subscription

With just a $6K balance in your savings account, you’ll earn more than $240 annually at the current APY,1 covering the cost of your subscription.

Experience the confidence that comes with up to $5M in FDIC insurance2

20x

How much more protection you’ll unlock compared to the industry standard via our partner bank and their sweep network.

Make money moves without manual tasks

- Create an account for every goal or expense

- Set auto-transfer rules between accounts

- Send no-fee domestic wires in seconds

- Drag-and-drop bills to pay them in a click

Room for everyone in your life

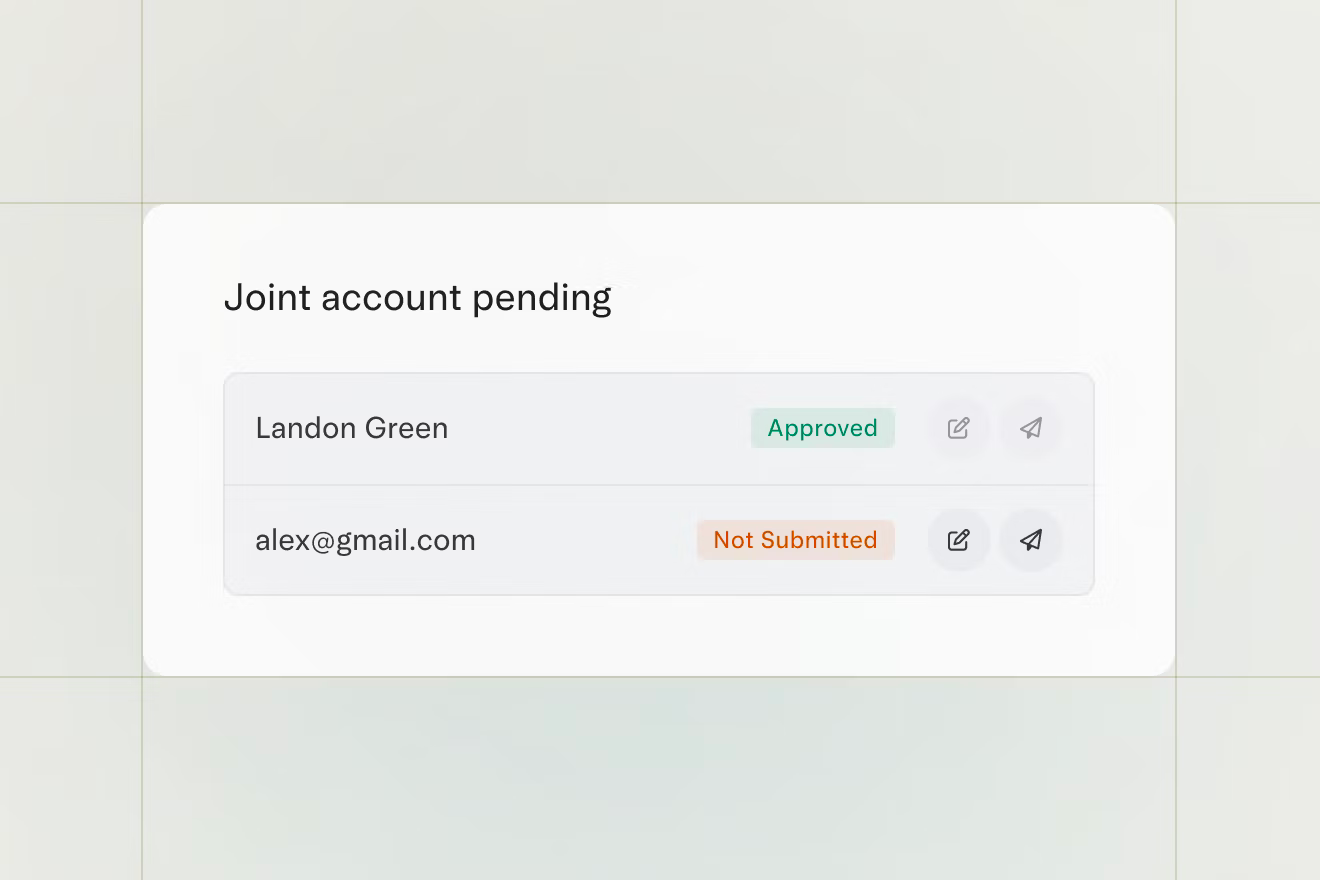

A joint account for your shared finances

Manage your finances like a winning team with joint accounts for up to four account owners.

$240 annually, $0 in surprise fees

Fine-tune your finances without minimums or hidden fees with a single annual subscription.

4.25% APY1 on savings

Included

Up to $5M FDIC insurance2

Included

Unlimited no-fee domestic wires, ACH, and check payments

Included

Reimbursed ATM fees worldwide4

Included

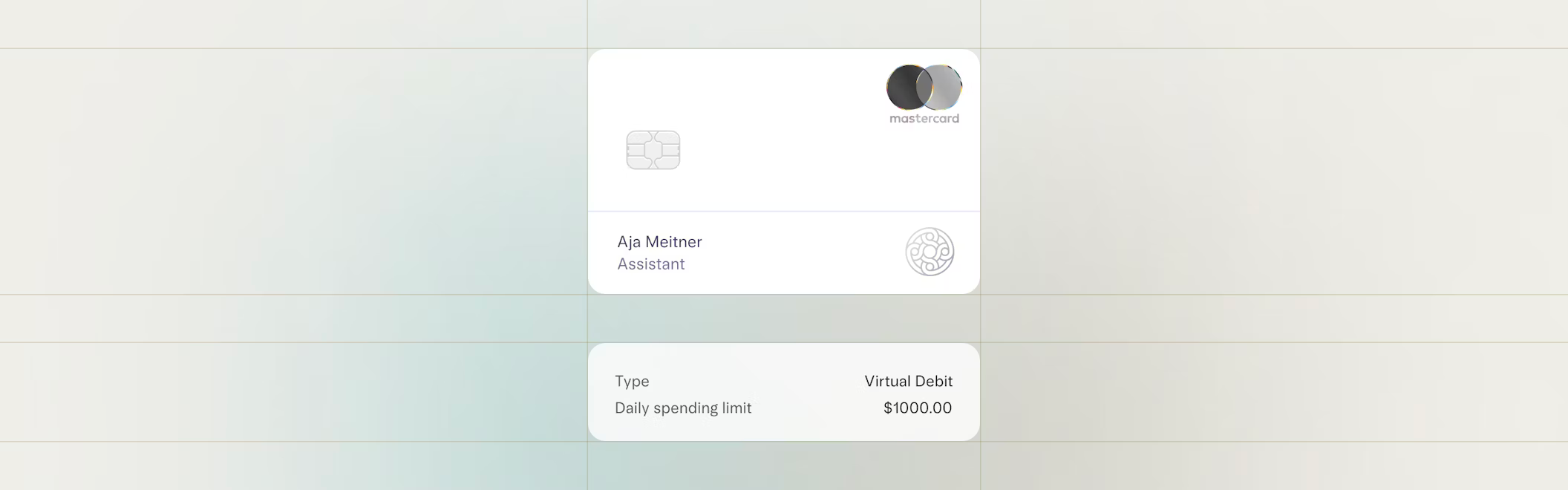

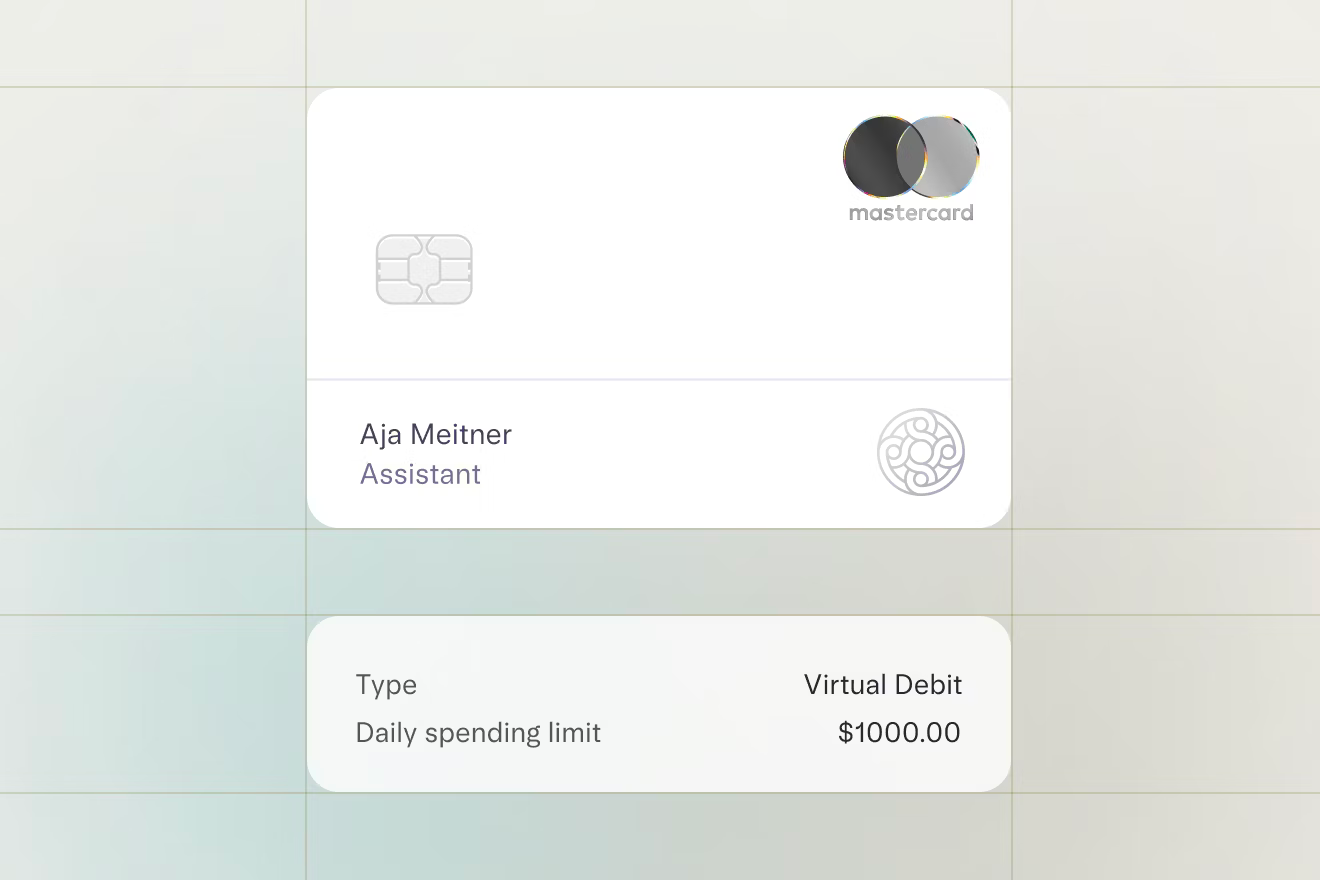

Debit cards3 with no foreign transaction fees

Included

Multiple checking and savings accounts

Included

Additional users and debit cards3 for any use case

Included

Joint account

Included

Investment account

Coming soon

International wires

Coming soon

How Mercury Personal stacks up

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO

Common Paper

SaaS

Frequently asked questions

What do I need to apply for an account?

Are my deposits FDIC-insured?

Where are my funds kept?

Can I apply for an account if I’m not physically in the United States or a United States resident?

What does it cost to use Mercury for businesses?

Join the waitlist

Spots in Mercury Personal are limited at launch. Sign up to add your name to the list and be one of the first to experience the future of personal banking.